You’ve identified your project’s goals. And now you’re in the planning phase of the project’s life cycle. At this point, you’re making plans to achieve your goals by creating a clear roadmap or timeline. And above all, in this phase, you’ll be creating the project’s budget.

Budgeting for project managers is an essential task that you can’t overlook. It’s not out of place to say that your project’s success depends on this task. After all, if you don’t plan for all expenses or run out of funds midway, it’ll severely affect the project. So, with that said, how do you create an effective project budget?

No need to worry. In this post, we’ve provided a comprehensive guide on budgeting for project managers. So, let’s get started.

What is Budgeting for Project Managers?

Budgeting refers to the process of determining the total amount of money allocated to a project and its tasks.

It is a crucial task that can severely affect the project’s outcome. And it doesn’t just start and end with coming up with an estimated figure that covers the cost of a project. Project budgeting involves much more. Let’s consider three basic tasks that project managers need to go through when creating the budget.

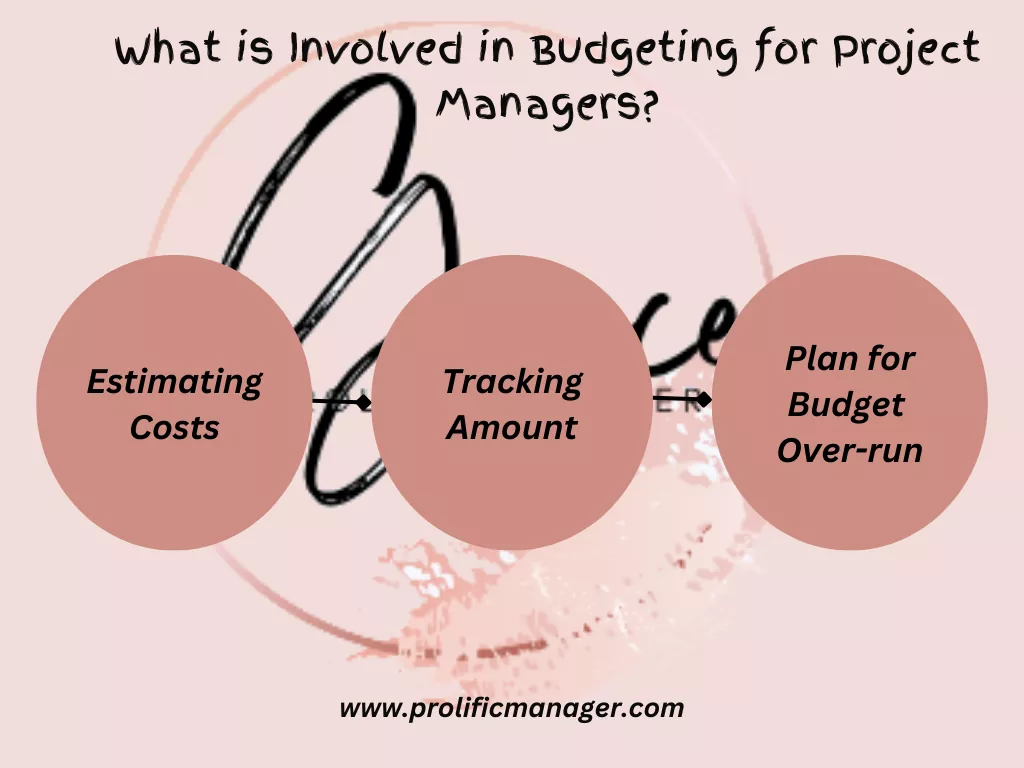

What is Involved in Budgeting for Project Managers?

1. Estimating individual costs

Before you can determine the amount needed to complete a project, you have to first understand the costs associated with the individual elements of the project. These individual elements include costs for tools, materials, and labor.

2. Tracking amount spent

During the project, you have to create an effective way for tracking the amount spent at each stage of the project. You’ll also have to compare the amount being spent with what was budgeted.

3. Plan for budget over-run

While you’ll take steps to ensure that your team doesn’t spend above the amount budgeted for a task, keep in mind that unexpected situations may still lead to such cases. And that’s why, as the project manager, you have to plan for such scenarios beforehand. Otherwise, it may delay the project and even threaten its success.

Without a doubt, budget management is not a one-step easy task. It requires lots of planning, prediction, and analysis to ensure the project is on track.

But why would one even want to put all that effort into budgeting? Is it really that important? Yes, it is. Once again, it is an aspect of the project management’s planning phase that dictates a project’s outcome. To see why, here are 4 things that make budgeting important for project managers.

Why is Budgeting Important?

1. Helps to allocate resources effectively

Resource allocation is the distribution of project resources (such as labor, tools, and funds) toward completing the tasks at hand. And since budgeting involves estimating individual costs, it allows you to ascertain how many resources a task needs.

This knowledge allows project managers to allocate the right number of resources to the right tasks at the right time.

2. Prioritizing tasks

Through budgeting, you’ll be able to prioritize tasks that are most important to the project. This is helpful, especially when you have a limited budget to work with. In such a case, you have to allocate your funds to complete the most important tasks first.

3. Prevents overspending

Remember the second step involved in project budgeting? It involves you tracking how much your team is spending at each stage in the project life cycle. Doing so will help you regulate funds and ensure your team follows the budget. All this prevents overspending.

4. Helps to analyze profits

How much does this project require? How much are we getting for it? How much profit will we make at the end of the project? Let’s be frank – the reason a firm takes on projects is to make a profit. That’s the only way the firm can improve its operations, pay expenses, and grow.

Budgeting is a project task that provides answers to those three questions. It allows a firm to determine the benefits a project offers to them and if it’s worth it.

These are only a few of the several benefits that come from project budgeting. Now, the question is: “Which project budgeting methods should you choose?”

Project budgeting methods. What are those? Let’s get right into that.

5 Methods of Budgeting for Project Managers

Project budgeting methods refers to the different approach project managers take toward their budget management. As a project manager, it is crucial that you understand each of these methods and carefully select the one that most suits your project and organization’s needs. To help you make that decision, here are five methods of budget management:

- Top-down budgeting

- Bottom-up budgeting

- Analogous estimation

- Three-point estimation

- Parametric estimation

No doubt you’re wondering what each of these terms means. Not to worry, here is a detailed explanation of each of these five methods:

1. Top-down Budgeting

Top-down is a famous budgeting method that involves setting a total amount for the entire project. Once done, that amount is broken down and allocated to smaller parts of the project. Team members who receive an allocation decide how best to use their allocated portion to complete their tasks.

In this method, the project manager is not necessarily the one who sets the “total amount” as it depends on the firm’s structure and the project’s significance. In most cases, members at the senior management level are in charge of making the decisions regarding the total amount.

They base their decision on considering historical data (such as past similar projects), market research results, and estimation results. Here, the project manager may be in charge of making research and providing data to inform decisions.

The Top-down method is a simple, fast, and easy-to-understand approach to project budgeting. That said, this method is not always accurate since it runs on assumptions.

What’s more, allocating roles and a portion of the budget to every team member discourages them from contributing to the firm’s decisions. Instead, they rigidly stick to their assigned roles. Because of this, it is not suitable for every firm.

2. Bottom-up Budgeting

As expected, this is the opposite of the Top-down method discussed above. Here, budgeting starts by identifying individual tasks and materials needed for a project. After identification, you estimate each of their costs and add them up to gain the total amount.

In this method, decision-making doesn’t solely rest on a group of team members. Since it focuses on estimating each task, it considers the ideas and opinions of all stakeholders, from executives to project team members.

While the top-down method starts by giving a “total amount” to work with and then dividing the amount by individual tasks, this method considers all individual tasks to get the “total amount”.

As such, while the top-down method is prone to missing some individual tasks, leading to inaccuracy, this method is more accurate and leads to a reliable amount for the budget.

However, since this method considers input from everyone, it takes more time to develop the budget. And also, clashes in ideas may lead to conflict within the firm.

3. Analogous Estimation

Analogous is another popular project budgeting method. It is an estimation technique of comparing a project with a similar previous one. You begin by identifying all the tasks and materials used to complete the past project. You identify how much they cost and how much you spent on the project overall.

Based on this information, you can draw a similar conclusion when creating the budget for the current project. Yes, that’s all. This estimation technique is easy to work with and saves time. It also helps when there’s limited information to work with.

That said, it’s only useful when there is a past project of similar nature to compare with. Otherwise, the data you’ll gain will be inaccurate and inapplicable. So, it’s not a helpful method when you have no past historical data to use.

4. Three-point Estimation

Here’s another project budget estimation technique. As the name indicates, it involves considering three points or three scenarios to arrive at your “average budget” amount. These are the positive or best case, negative or worst case, and most likely cases.

The best case (BC) represents the outcome where everything goes perfectly, according to your plan. On the other hand, the worst-case (WC) represents the outcome where things go badly, which results in project delay. Your most likely (ML) case falls in their midst. After attributing an estimated amount to each case, you then proceed to calculate your average budget using either one of these two formulas:

- BC + 4ML + WC / 6 (Beta Formula)

- BC + ML + WC / 3 (Triangular Formula)

In the Beta formula, the ML case weighs four times more than the other two scenarios. Though this formula is more complex, it is more renowned for yielding more accurate results as it allows for more possible outcomes.

On the other hand, the Triangular formula is simpler and evenly distributes the probability level across all three scenarios. As a project manager, understanding these formulas or distributions will help you choose the right one for your project.

Overall, the three-point estimation is an accurate and impressive way of calculating project outcomes. However, it may not work for all projects. And it takes more time to apply three case outcomes to every project task.

5. Parametric Estimation

Like the Analogous method discussed above, the parametric estimation method uses historical data. However, it goes one step further to make use of measurable parameters. By multiplying your historical data with the project’s parameters, you can calculate the estimated cost of a project.

For instance, you want to publish a book that consists of 300 pages. In past similar works, you’ve ascertained that the average cost of publishing a book per page is $10 from formatting to design.

In this case, the average cost from previous works ($10) is your historical data, and the number of pages (300) is your project’s parameter. So, 10 * 300 = 3000 (the estimated project cost).

Like the analogous method above, it’s not applicable when there are no past data to work with. As a result, its use cases are limited.

These five methods of budgeting for project managers are different approaches that can help a firm create its budget effectively. Once you’ve created your budget, you’ll need to manage and keep track of it. And this is where project budgeting tools come into play.

What are the Best Tools for Project Budgeting?

Project budgeting tools are software and applications that help a project manager to carry out budgeting tasks effectively.

As expected, there are several of these tools available for use. The following are three of these widely-used tools:

1. Smartsheet

Smartsheet is a popular project management tool that allows project teams to plan and manage their tasks. It also offers templates suitable for tracking budgets and project expenses.

2. Trello

Trello is another project management tool offering budget tracking capabilities. Through boards, you can monitor how the budget is being spent.

3. Airtable

Airtable also comes with several budgeting features for individuals and firms. These features allow you to tie budgets to goals, move money between different budgets, and track your budget balances.

Wrapping Up

Without budgeting, it becomes a challenge for firms to regulate resources thereby affecting the outcome of their project. And that’s why as a project manager, it’s your job to ensure a project budget is made and followed by all members of the team.

The five project budgeting methods discussed in this article, while having their downsides, are great ways of creating a budget. And by using project tools, you can make your tasks much easy. So, get started today on your project budgeting, as it greatly determines your firm’s success.